In today’s fast-paced business world, efficiency is key. Every aspect of a company’s operations, no matter how seemingly mundane, plays a crucial role in its success. Among these critical components is invoice management. Efficient invoice management not only ensures timely payments but also streamlines accounting processes, reduces errors, and improves cash flow. Recognizing the significance of this function, businesses are increasingly turning to invoice management software to automate and optimize their invoicing processes. In this article, we delve into the features, benefits, and considerations of invoice management software, exploring how it revolutionizes financial operations for businesses of all sizes.

Contents

Understanding Invoice Management Software

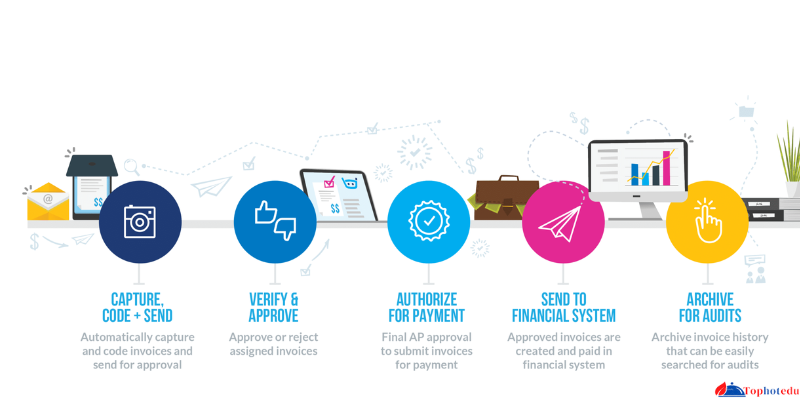

Invoice management software is a digital solution designed to simplify and automate the entire invoicing process, from creation to payment. It eliminates the need for manual data entry, paper invoices, and the cumbersome task of tracking payments manually. Instead, it offers a centralized platform where businesses can generate, send, track, and manage invoices effortlessly. Modern invoice management software often integrates with accounting systems, CRMs (Customer Relationship Management), and other business tools, providing a seamless workflow across various departments.

Key Features of Invoice Management Software

- Invoice Generation: These software solutions allow users to create professional-looking invoices quickly. Users can customize invoice templates with their company logo, branding elements, payment terms, and other relevant information.

- Automation: Automation is at the core of invoice management software. It automates repetitive tasks such as recurring invoicing, payment reminders, and late fee calculations. By reducing manual intervention, businesses save time and minimize errors.

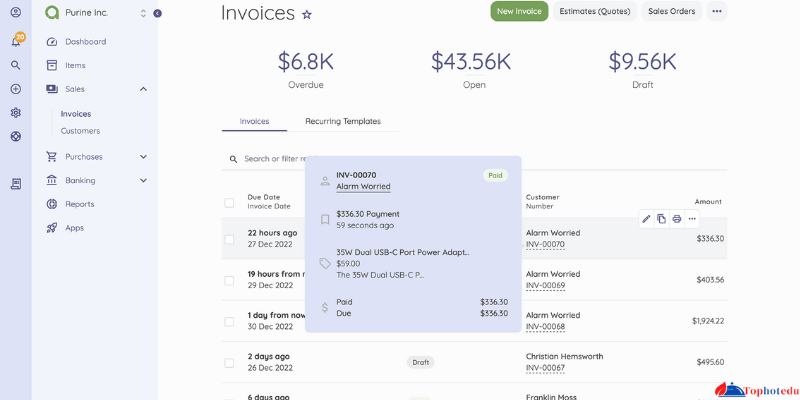

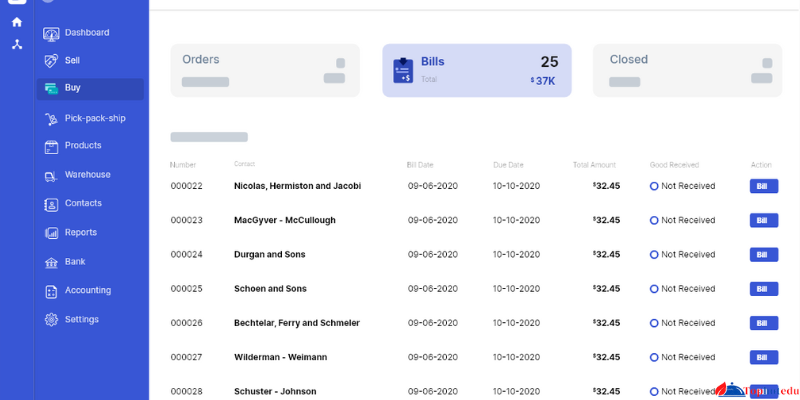

- Invoice Tracking: Keeping track of invoices can be challenging, especially for businesses with a high volume of transactions. Invoice management software simplifies this process by providing real-time tracking of invoices. Users can monitor the status of each invoice, whether it’s pending, sent, paid, or overdue.

- Payment Integration: Integration with payment gateways enables businesses to accept online payments directly through the software. This feature accelerates the payment cycle and improves cash flow by offering customers convenient payment options.

- Expense Management: Some invoice management software includes expense tracking capabilities, allowing businesses to record and categorize expenses associated with each project or client. This feature provides a comprehensive view of financial transactions and facilitates budgeting and reporting.

- Reporting and Analytics: Robust reporting tools provide insights into financial performance, including revenue, outstanding payments, and profitability by client or project. Analytical dashboards help businesses make informed decisions and identify areas for improvement.

- Compliance and Security: Compliance with tax regulations and data security are paramount in invoice management. Leading software solutions adhere to industry standards and offer features such as tax calculation, VAT (Value-Added Tax) handling, and data encryption to ensure compliance and protect sensitive information.

Benefits of Invoice Management Software

- Improved Efficiency: By automating invoicing tasks, businesses can significantly improve efficiency and productivity. Staff can focus on value-added activities rather than spending time on manual paperwork.

- Faster Payments: Timely invoicing and automated payment reminders accelerate the payment cycle, reducing the average time it takes to receive payments. This, in turn, improves cash flow and liquidity.

- Reduced Errors: Manual data entry is prone to errors, leading to discrepancies and delays. Invoice management software minimizes errors by automating data entry and validation, ensuring accuracy and consistency in invoicing.

- Enhanced Customer Experience: Professional-looking invoices and convenient payment options enhance the customer experience. Businesses that prioritize user-friendly invoicing processes build trust and loyalty with their clients.

- Cost Savings: While there is an initial investment in implementing invoice management software, the long-term cost savings are substantial. Reduced administrative overhead, fewer late payments, and improved financial visibility contribute to overall cost savings for businesses.

- Scalability: Invoice management software is scalable, making it suitable for businesses of all sizes. Whether you’re a freelancer, small startup, or a large enterprise, you can tailor the software to meet your specific needs and scale as your business grows.

- Better Decision-Making: Real-time insights and analytics provided by invoice management software empower businesses to make data-driven decisions. By understanding cash flow patterns, revenue trends, and client payment behaviors, businesses can strategize effectively and optimize their financial performance.

Considerations When Choosing Invoice Management Software

- User-Friendly Interface: Look for software with an intuitive interface that is easy to navigate and use. Training requirements should be minimal to ensure quick adoption by your team.

- Integration Capabilities: Ensure that the software integrates seamlessly with your existing systems, such as accounting software, CRMs, and payment gateways. Compatibility with other tools enhances workflow efficiency and data accuracy.

- Customization Options: Choose software that allows customization of invoice templates, payment terms, and branding elements to reflect your company’s identity and meet specific client requirements.

- Security Measures: Prioritize software vendors that adhere to industry-standard security protocols and offer features such as data encryption, secure payment processing, and regular data backups to safeguard your sensitive information.

- Scalability and Pricing: Consider your future growth plans and choose software that can scale with your business. Evaluate pricing models, including subscription plans and pricing tiers, to ensure that the software remains cost-effective as your business expands.

- Customer Support: Reliable customer support is essential, especially during implementation and troubleshooting. Choose a vendor with responsive customer support channels and comprehensive documentation to assist you whenever needed.

- Reviews and Reputation: Research vendor reputation and read customer reviews to gauge user satisfaction and identify any potential issues or limitations of the software.

Conclusion

Invoice management software is a powerful tool that transforms the way businesses handle invoicing and financial operations. By automating repetitive tasks, improving efficiency, and providing valuable insights, it empowers businesses to optimize cash flow, enhance customer relationships, and drive growth. When choosing invoice management software, consider your specific requirements, integration needs, and long-term scalability to select the solution that best fits your business objectives. With the right software in place, you can streamline your invoicing processes and unlock the full potential of your business.